TLDR, Fintech, and Artificial Intelligence ecosystems are on fire🔥. Augmenting Financial technologies with AI probably has the potential to go far beyond. 🔌 If you're looking to collaborate or partner with someone who understands and has practical experience in Fintech and AI, I know someone 😎.

I have used the data compiled by CBInsights for exploration and some basic insights. The data may or may not include the entire unicorn universe, so treat this as information based on the visible universe.

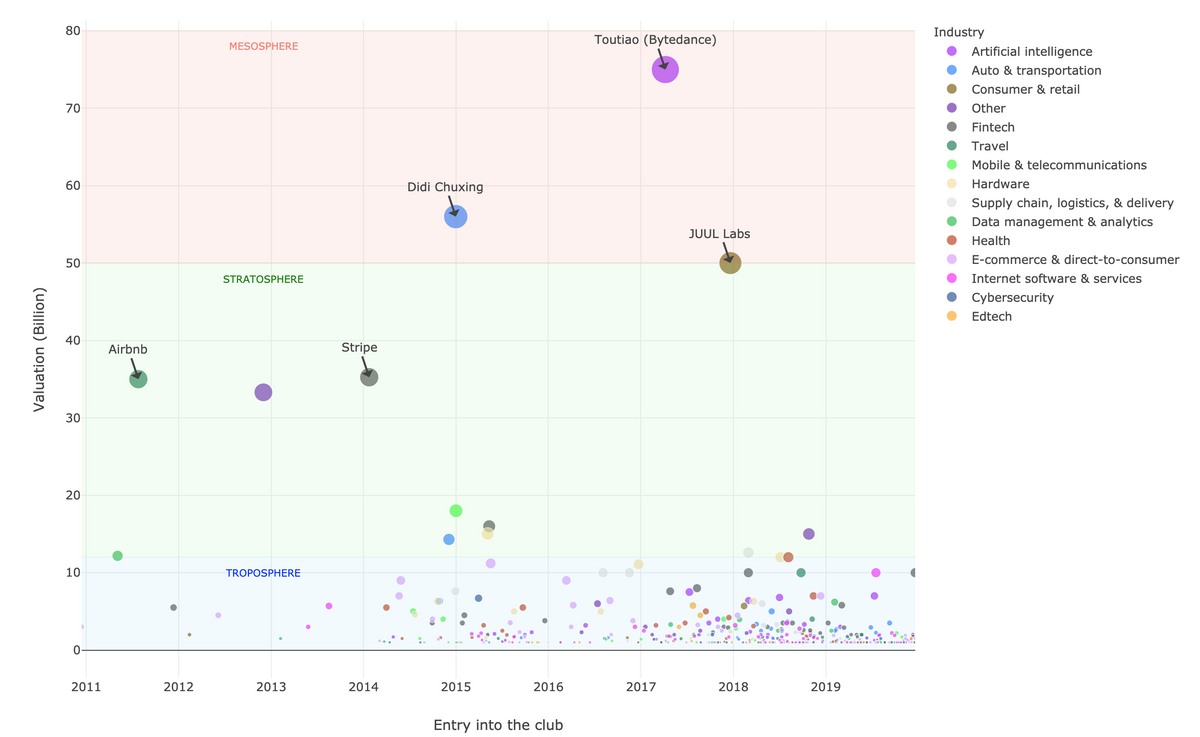

There are 440 companies in the 🦄Unicorn club. The valuation ranges from 1B to the maximum 75B. The plot below shows the broad valuation spectrum within the club. While there are terms such as Decacorn, Hectocorn, etc. I chose to map them using the layers of the atmosphere (see what I did there 🚀😉)

97% of startups exist in the Troposphere, 2.5% in Stratosphere, and a mere 0.5% in the Mesosphere. The top two in the club, Bytedance and Didi Chuxing, are headquartered in China, and both founded in 2012.

Most companies in the club are recent entrants, 60% joined the Unicorn club in the last two years.

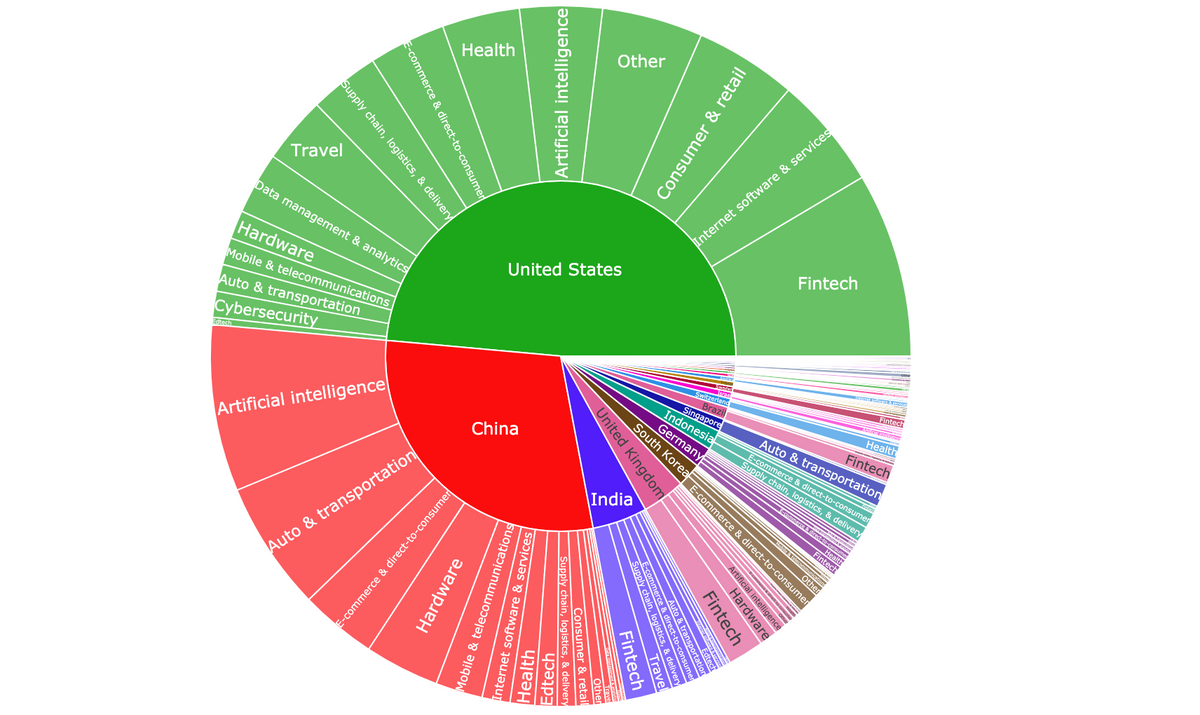

Almost half of the companies are from the United States. China is a distant second with half as many companies as the United States. And, the rest of the world makes up for the quarter in the club.

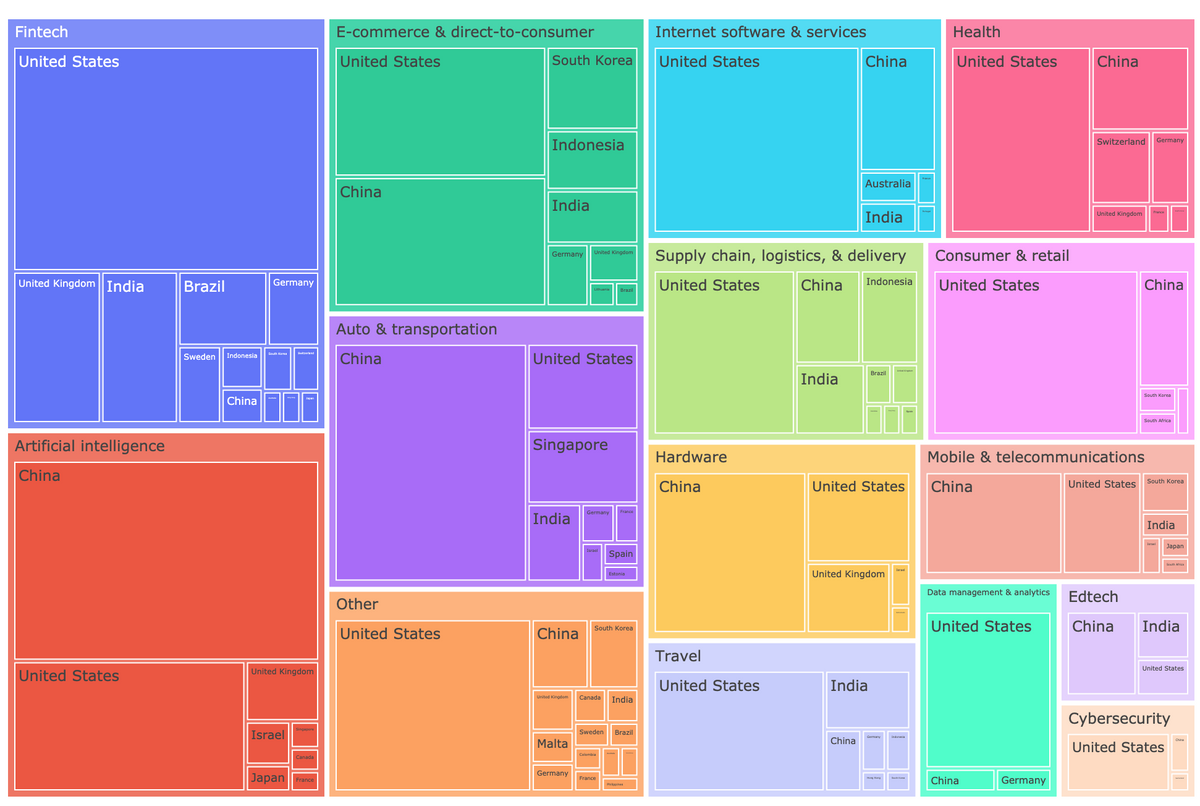

Fintech, E-commerce, Internet Software Services, and Artificial Intelligence have produced the most number of Unicorns. Cybersecurity and Edtech have the least representation. However, I am glad to see them on the list.

* Size = number of companies

Fintech and Artificial Intelligence lead the valuation list, which is the total valuation in every Industry. I expect covariant.ai🔥, just out of the stealth, to join 🚀 the club soon. The company was founded and is lead by some of the brightest minds in AI.

* Size = company valuation

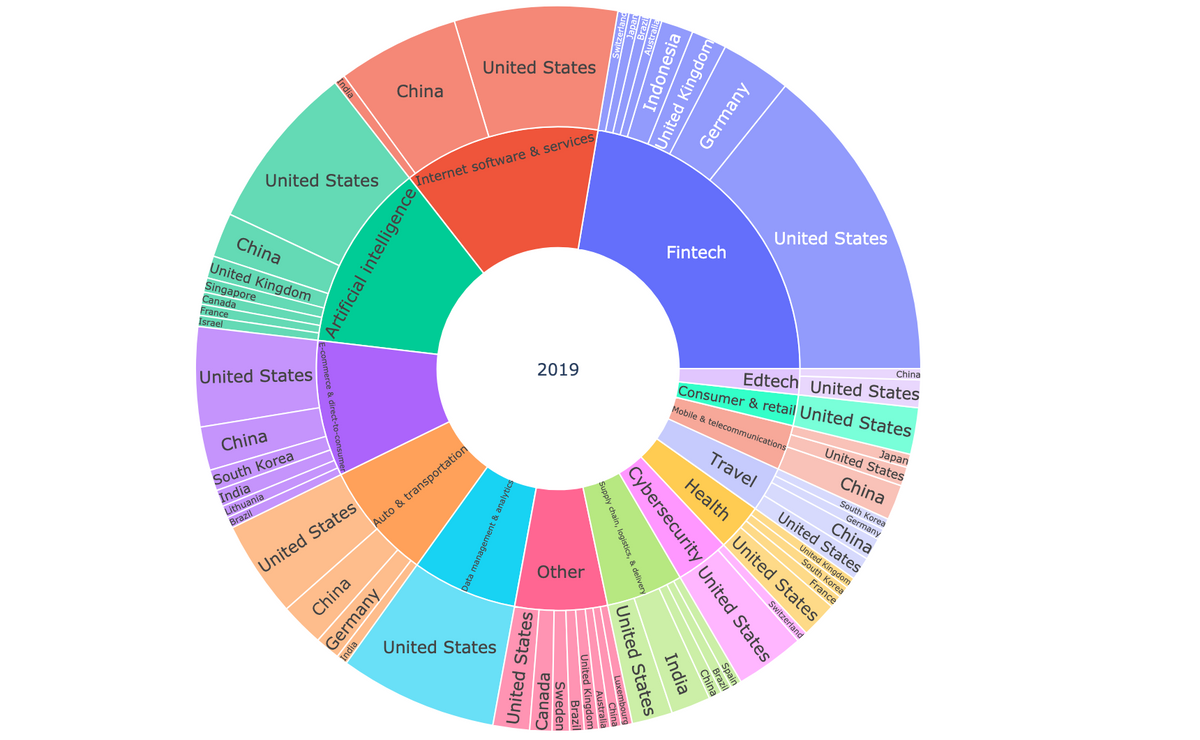

Although American and Chinese companies dominate the yearly list of new Unicorns, the last few years have witnessed companies from the United Kingdom, India, Germany, among others.

A snapshot from 2019 showing companies from the diverse range of industries and countries join the club.

* Size = number of companies

There are Thirteen countries in the Fintech category, by far the most in any industry, not including others category. It is also the most active category.In contrast, only three countries represent Cybersecurity, Edtech, and Data Analytics, two of which are the United States and China.

This plot shows the valuation of each industry grouped by the country. We see again that companies from the United States dominate the list, and approx 75% of valuation comes from the companies from the United States and China combined. Interestingly, China hardly seems to have any representation in the Fintech category, which is odd 🤔because Ant Financial, according to Wikipedia, is the world's most valuable unicorn with a valuation of US $150B.

* Size = company valuation

The plot below gives a concise view of key players in each industry. The companies from the United States and China cover all 15 sectors. Besides them, the companies from India cover most industries (9 out total 15), the United Kingdom in 8 and South Korea includes 7 out of the full 15.

* Size = company valuation

And finally I leave you with two plots that show the yearly action in each industry. Although trend is clearly not their friend, I am hoping to see more action in the Edtech, Health and Cybersecurity industries.

For me, the key observation is that the unicorn club added nearly 75% of its companies in the last three years. Put that in perspective with the fact that we've witnessed the longest and the best bull market ever.

That's all folks